This Biotech Beat the Market Leader 63%-to-0% in Phase II Trials (NASDAQ: MDWD)

MediWound has a product already on the market, no long-term debt, substantial non-dilutive government funding, and a Phase III asset going after a market dominated by a single 60-year-old drug

Chronic wounds are not something most investors think about. But they should.

More than 10 million Medicare beneficiaries in the United States suffer from wounds that refuse to heal, including diabetic foot ulcers, venous leg ulcers, and pressure sores. These conditions cost Medicare more than $22 billion annually. For patients with diabetic foot ulcers, the five-year mortality rate has been shown in multiple studies to be comparable to that of many cancers. And as the population ages, the problem is getting worse. The number of Americans over 65 is projected to nearly double by 2060, with the 85-plus cohort roughly tripling in size.

MediWound Ltd. (NASDAQ: MDWD), an Israeli biotech that has spent over a decade developing an enzymatic platform technology designed to treat wounds without surgery. The company already has one FDA-approved product for burn indication generating revenue and is advancing a Phase III candidate for venous leg ulcers targeting a market segment that has not seen a new approved enzymatic drug since 1965.

Separately, the World Health Organization has published updated guidance for burn care in mass-casualty settings that includes enzymatic debridement as an accepted approach, reflecting broader validation of the treatment modality that underpins NexoBrid.

A Commercial Product With Momentum

MediWound’s flagship product, NexoBrid, is approved in more than 40 countries for the removal of dead tissue in severe burns. The drug uses a mixture of proteolytic enzymes derived from pineapple stems to selectively dissolve burned tissue in a single four-hour application, without the need for surgical excision. NexoBrid has received regulatory approval in the U.S., Europe, and Japan, including indications that allow for use in both adult and pediatric patients.

In the United States, NexoBrid is commercialized by Vericel. In its most recent quarterly report, Vericel disclosed 38% year-over-year revenue growth for NexoBrid, reflecting continued adoption following its U.S. launch. MediWound is also completing a manufacturing expansion which will enable production capacity to increase by up to sixfold by the end of 2025.

For full-year 2024, MediWound reported approximately $20 million in total revenue. While NexoBrid is still early in its commercial ramp in the U.S., it is already demonstrating meaningful momentum.

What makes this unusual for a small biotech is the balance sheet. As of September 30, 2025, MediWound reported approximately $60 million in cash, cash equivalents, and short-term deposits, with no material long-term debt. Over the years, the company has also secured significant non-dilutive U.S. governmental funding. This includes more than $120 million in cumulative support from BARDA through various contracts and awards, approximately $14 million in U.S. Department of Defense funding to support development of a temperature-stable formulation for battlefield use, and €2.5 million from the European Innovation Council. This is not a company burning cash with nothing to show for it.

The Bigger Opportunity: EscharEx

While NexoBrid validates the platform commercially, MediWound’s pipeline candidate EscharEx targets a far larger opportunity: the chronic wound debridement market, estimated at more than $2.5 billion annually.

Debridement—the removal of dead or necrotic tissue—is a critical first step in healing chronic wounds. Today, most debridement is performed surgically or through slow-acting methods such as hydrogels. The only FDA-approved enzymatic option widely used in this setting is SANTYL, a collagenase ointment originally approved in 1965. Despite requiring daily applications over weeks, SANTYL is estimated to generate more than $370 million in annual U.S. sales.

MediWound believes that a faster-acting and more effective enzymatic alternative could meaningfully disrupt this market, pulling share from both surgical procedures and legacy treatments while potentially expanding the overall category.

According to market research cited by the company, roughly 3 million patients in the U.S. with diabetic foot ulcers or venous leg ulcers undergo debridement each year. At current treatment economics, that translates into an estimated $2.5 billion addressable opportunity. While SANTYL has been on the market for decades, published reviews note that its clinical evidence base consists of a limited number of randomized studies, many of which predate modern trial design standards.

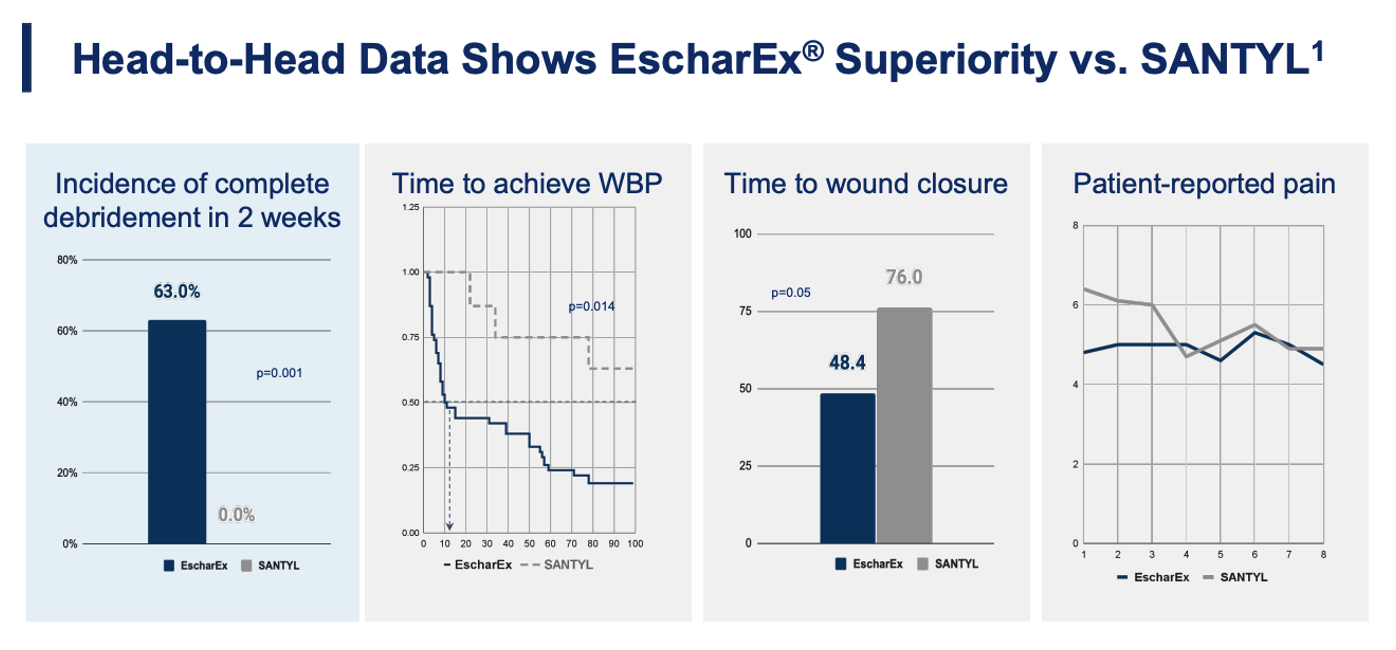

In a Phase II study that included a post-hoc analysis of head-to-head comparison published in the peer-reviewed journal Wounds, EscharEx achieved complete debridement in 63% of patients within two weeks. In the same analysis, none of the patients treated with SANTYL achieved complete debridement over that timeframe. Wound bed preparation—a key predictor of downstream healing—was reached by 50% of EscharEx patients versus 0% for SANTYL within eleven days. Among patients whose wounds ultimately closed, EscharEx-treated wounds closed in an average of 48 days compared to 76 days for those treated with SANTYL.

MediWound initiated its pivotal Phase III trial for EscharEx, known as VALUE, in early 2025. The study is designed to enroll 216 patients across approximately 40 sites in the United States and Europe. An interim analysis is expected in mid-2026. In parallel, the company has indicated plans to advance EscharEx into additional clinical studies in diabetic foot ulcers, supported in part by European Innovation Council funding.

Industry Validation

Another signal of growing interest is the level of industry participation around EscharEx. MediWound has established formal research collaborations supporting the VALUE trial with several major wound-care players, including Mölnlycke, Solventum, and MIMEDX, which are contributing products and expertise to the study. In addition, Mölnlycke led a $25 million private investment in MediWound in 2024, committing $15 million itself.

The Setup

MediWound currently trades at a market capitalization of roughly ~$250 million. The company has a commercial product showing accelerating adoption, a late-stage pipeline asset with Phase II data demonstrating markedly faster debridement than the long-standing standard of care, a strong cash position supported by substantial non-dilutive government funding, and multiple clinical and operational catalysts ahead.

Ultimately, Phase III data will determine whether EscharEx can replicate its earlier results at scale. But for a company with growing revenue, a solid balance sheet, deep government backing, and a differentiated enzymatic platform, the risk-reward profile seems attractive.

Read this Next >> Big Pharma’s GLP-1 Delivery Race May Highlight Opportunities Below the Surface

Recent News Highlights from MediWound

MediWound Reports Third Quarter 2025 Financial Results and Provides Corporate Update

MediWound Successfully Completes Commissioning of Expanded GMP Manufacturing Facility for NexoBrid

Important Disclaimers and Disclosures: The author, Wall Street Wire, is a content and media technology platform that connects the market with under-the-radar companies. The platform operates a network of industry-focused media channels spanning finance, biopharma, cyber, AI, and additional sectors, delivering insights on both broader market developments and emerging or overlooked companies. The content above is a form of paid promotional content and advertising. Wall Street Wire has received cash compensation from MediWound Ltd for promotional media services, which are provided on an ongoing basis. This content is for informational purposes only and does not constitute financial or investment advice. Wall Street Wire is not a broker-dealer or investment adviser. Full compensation details, information about the operator of Wall Street Wire, and the complete set of disclaimers and disclosures applicable to this content are available at: wallstwire.ai/disclosures. Market size figures or other estimates referenced in this article are quoted from publicly available sources; we do not independently verify or endorse them, and additional figures or estimates may exist. This article should not be considered an official communication of the issuer.