Hypothalamic Obesity Is Emerging as the Next Frontier in Obesity Drug Development - and Palatin Is Worth Watching

For most investors, “obesity drugs” now means GLP-1s. But not all obesity is lifestyle-driven, and not all patients respond to incretins - hormone-based drugs like GLP-1s that suppress appetite. One of the most severe and underserved forms of obesity - hypothalamic obesity (HO) - sits largely outside the GLP-1 boom.

That disconnect is where Palatin Technologies (NYSE American: PTN), a little-known clinical-stage biotech, is quietly focusing its efforts. While largely under the radar, Palatin is developing drugs for patients whose obesity is rooted not in behavior or metabolism alone, but in damage to the brain’s appetite-regulating center - patients for whom existing therapies often fail.

Hypothalamic obesity typically follows injury to the hypothalamus, most commonly after surgery or radiation to remove tumors near the brain. The result is relentless hunger and rapid weight gain that diet, exercise, and even bariatric surgery rarely control. These patients are easy to identify, managed by specialists, and usually require lifelong treatment - characteristics that make HO resemble an orphan disease rather than a mass-market obesity indication.

A Validated Pathway - and a New Design Problem

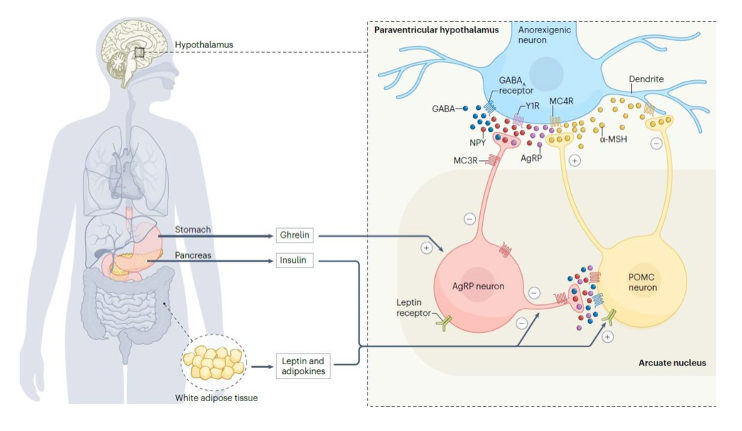

The biology behind hypothalamic obesity is no longer speculative. Drugs that activate the melanocortin-4 receptor (MC4R) - a central regulator of appetite and energy balance - have demonstrated that restoring signaling in this pathway can produce meaningful weight loss in affected patients.

Most notably, Rhythm Pharmaceuticals (NADSAQ: RYTM), the first and only company to successfully commercialize an MC4R-targeted therapy for the treatment of obesity, has built a public-market franchise valued in the multi-billion-dollar range around MC4R pathway treatments for rare genetic obesity disorders. Its success has effectively validated MC4R as a therapeutic target and established hypothalamic obesity as a legitimate drug development category.

For investors, that validation matters because it substantially reduces biological risk. But as the field has matured, another reality has emerged: efficacy is no longer the primary bottleneck - patient tolerability is.

Publicly disclosed data from MC4R programs show that while significant weight loss can be achieved, side effects such as nausea, vomiting, and skin hyperpigmentation - linked to activity at related melanocortin receptors - can limit broader or long-term use. As a result, the challenge has shifted from proving the biology to designing drugs that patients can better tolerate.

In other words, the central question facing next-generation MC4R therapies is no longer whether the pathway works, but whether it can be harnessed in a way suitable for sustained treatment.

Where Palatin Fits

Palatin’s strategy is shaped by that exact shift. The Company is not new to melanocortin biology; it was the first to bring a melanocortin-based drug to FDA approval and has spent decades studying how receptor selectivity and pharmacokinetics influence both efficacy and side effects.

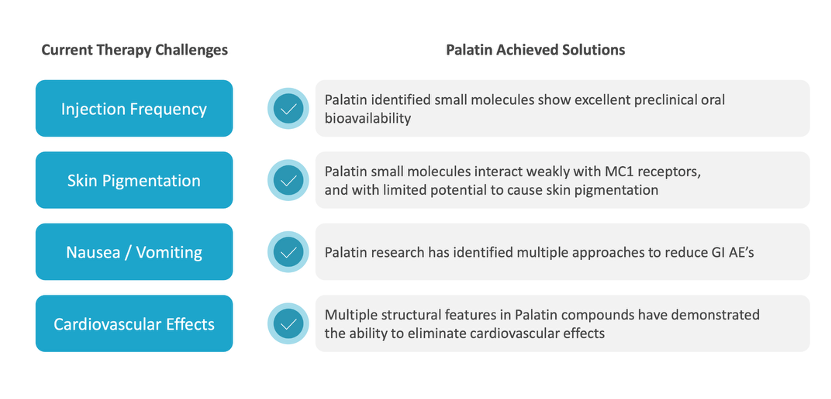

Palatin is designing next-generation MC4R therapies explicitly around the limitations identified by earlier programs, particularly tolerability and off-target receptor activity.

Two Shots on Goal, One Focus

Palatin is advancing two MC4R candidates with hypothalamic obesity as the lead indication:

- PL7737, a once-daily oral small-molecule MC4R agonist currently in IND-enabling studies, and

- A long-acting, once-weekly injectable MC4R peptide, aimed at patients who prefer less frequent dosing.

In preclinical models, PL7737 has demonstrated MC4R-dependent weight loss alongside a controlled pharmacokinetic profile designed to avoid sharp peak drug exposure - often associated with gastrointestinal side effects. The compound also shows limited activity at MC1R receptors, which are linked to skin hyperpigmentation.

These results are positive but preclinical, and human data will ultimately determine whether these design choices translate into improved tolerability. Still, the strategy reflects a field that has moved beyond first-generation trial-and-error toward more intentional drug engineering.

Palatin expects to file INDs for its MC4R programs in 2026, with early clinical studies planned to include both obese patients and hypothalamic obesity patients, with just hypothalamic obesity patients in later clinical phases.

Beyond Hypothalamic Obesity: Optionality and Platform Validation

While hypothalamic obesity treatment is Palatin’s lead focus, the Company’s work in MC4R biology extends beyond a single indication. Palatin has generated clinical and preclinical data suggesting MC4R agonism may also play a role in broader obesity management, including in combination with existing GLP-1 therapies. These programs are not the Company’s immediate priority, but they highlight the flexibility of the platform and its longer-term expansion potential.

That optionality is reinforced by something many early-stage biotechs lack: existing non-obesity assets with clinical validation, external interest and third-party collaborations.

Palatin has multiple programs outside obesity, including inflammatory, renal, and ocular diseases. Most notably, in 2025 the Company entered a research collaboration with Boehringer Ingelheim to develop melanocortin-based therapies for retinal diseases. The agreement included an upfront payment, research milestones, and the potential for downstream development and commercial milestones, along with royalties.

Crucially for investors, this collaboration has already generated meaningful non-dilutive cash inflows, validating both the underlying biology and Palatin’s ability to partner its platform with large pharmaceutical companies. Additional milestone payments remain possible as the program advances.

Taken together, Palatin’s broader optionality and partnered assets reduce the binary risk often associated with small-cap biotech companies.

What Investors Are Really Betting On

Palatin is not a bet on whether MC4R works. That question has largely been answered.

It is a bet on whether next-generation MC4R therapies - designed with tolerability, selectivity, and long-term use in mind - can meaningfully improve on what the first wave revealed.

For investors, the appeal lies in the asymmetry: a validated biological pathway, a focused orphan-style indication, disciplined development timelines, and an under-the-radar company applying deep domain expertise to a problem the field now understands far better than it once did.

As clinical data emerge, the answer will become clearer. Until then, Palatin represents a measured attempt to advance a proven mechanism - not by chasing hype, but by addressing the constraints that follow validation.

Several Wall Street analysts have initiated coverage in recent months with positive ratings, reflecting growing interest in the platform’s potential. Of course, clinical-stage biotechs carry significant risk, and positive animal data does not guarantee success in humans.

Still, for a company currently valued at a fraction of other sector players' valuations, with differentiated drug candidates addressing known limitations and supported by non-dilutive Big Pharma funding, Palatin may offer an intriguing setup heading into a year with multiple potential catalysts.

Read this next >> Big Pharma’s GLP-1 Delivery Race May Highlight Opportunities Below the Surface

Recent News Highlights from Palatin

Important Disclaimers and Disclosures: The author, Wall Street Wire, is a content and media technology platform that connects the market with under-the-radar companies. The platform operates a network of industry-focused media channels spanning finance, biopharma, cyber, AI, and additional sectors, delivering insights on both broader market developments and emerging or overlooked companies. The content above is a form of paid promotional content and advertising. Wall Street Wire has received cash compensation from Palatin Technologies Inc for promotional media services which are provided on an ongoing basis. This content is for informational purposes only and does not constitute financial or investment advice. Wall Street Wire is not a broker-dealer or investment adviser. Full compensation details, information about the operator of Wall Street Wire, and the complete set of disclaimers and disclosures applicable to this content are available at: wallstwire.ai/disclosures. Market size figures or other estimates referenced in this article are quoted from publicly available sources; we do not independently verify or endorse them, and additional figures or estimates may exist. This article should not be considered an official communication of the issuer.