Big Pharma’s GLP-1 Delivery Race May Highlight Opportunities Below the Surface

GLP-1 drugs have reshaped the treatment of obesity and diabetes, and innovation in the category is accelerating. The FDA approval of an oral version of Wegovy for chronic weight management marked a major milestone, expanding access to GLP-1 therapy and offering a new option for patients reluctant to use injections.

Rather than signaling an endpoint, however, the launch of a daily pill is increasingly seen as the beginning of a broader evolution in how these therapies are delivered - one that is drawing attention beyond large pharmaceutical companies to smaller players exploring next-generation delivery platforms. One such company is PolyPid Ltd. (NASDAQ: PYPD).

Oral Delivery - An Imperfect Solution

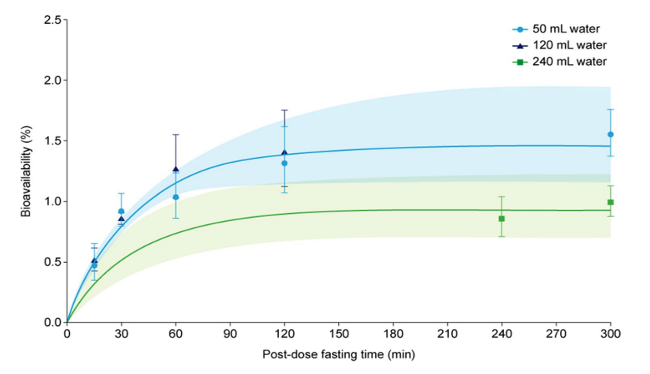

Oral GLP-1s represent a meaningful step forward, but they also highlight a deeper limitation that goes beyond convenience. Daily and weekly GLP-1 regimens typically produce peaks and troughs in drug exposure, with higher concentrations shortly after dosing followed by declines before the next dose. These fluctuations are associated with gastrointestinal side effects and variability in tolerability - factors that remain among the leading reasons patients discontinue therapy.

As oral GLP-1s enter the market, attention is increasingly shifting toward delivery approaches that can maintain steadier drug exposure over longer periods, potentially improving tolerability and long-term persistence, while also supporting adherence by reducing dosing frequency. At the same time, major pharmaceutical companies are seeking to capture a larger share of this significant market through acquisitions and partnerships.

The delivery arms race

Over the past two years, major pharmaceutical companies have committed significant capital to longer-acting injectable GLP-1 delivery approaches. In 2024, Novo Nordisk entered a $285 million agreement with Ascendis Pharma to access once-monthly injections designed to release medication slowly overtime. That momentum continued in mid-2025, when Eli Lilly agreed to pay Camurus up to $870 million for injectable technology designed to extend dosing intervals for GLP-1 and related metabolic hormones.

These deals point to a clear industry signal. With oral GLP-1s now entering the market, attention is already shifting to what comes next. Reducing dosing frequency is emerging as a competitive frontier alongside weight loss efficacy and tolerability in a market projected to approach $100 billion by the end of the decade. As capital flows toward delivery platforms, interest is also growing in smaller companies pursuing similar concepts outside the spotlight.

A different path

PolyPid (NASDAQ: PYPD), a biotech firm best known for its late-stage surgical infection program, announced in July that it is conducting preclinical work on a long-acting GLP-1 delivery platform designed to support approximately 60 days of sustained release from a single subcutaneous injection.

If successful, this approach would translate to roughly six injections per year. Rather than competing directly with daily (?) oral pills, the strategy targets patients who are already comfortable with injections but would prefer to receive them far less often. Conceptually, it aligns with the same direction large pharmaceutical companies are pursuing, albeit at an earlier stage and outside the current valuation narrative.

Experience matters

While PolyPid’s GLP-1 platform is still early, the company is not new to the challenges of long-duration drug delivery. Its development team has spent years working on controlled-release systems designed to deliver medication at predictable rates over extended periods.

That experience has already translated into late-stage clinical execution. In June 2025, PolyPid reported positive Phase 3 results from its SHIELD II trial of D-PLEX100 for surgical site infection prevention. The study demonstrated a statistically significant reduction in infections compared to standard care and met all primary and secondary endpoints. Across two Phase 3 trials, PolyPid has evaluated localized drug delivery approaches in more than 1,000 patients without major safety concerns. An NDA submission for D-PLEX100 is expected in the first quarter of 2026.

The GLP-1 program represents a separate development effort, tailored specifically for metabolic disease. The company has indicated that this platform is being designed with different performance requirements in mind, including the goal of maintaining steadier drug exposure over time.

That distinction matters because current weekly GLP-1 injections often produce peaks and troughs in drug concentration. Those fluctuations are believed to contribute to gastrointestinal side effects, which remain one of the leading reasons patients discontinue therapy. A delivery profile that avoids sharp concentration spikes could potentially improve tolerability, though this hypothesis will need to be tested in clinical trials.

Risk, positioning, and the bigger picture

PolyPid’s GLP-1 program remains in the preclinical stage and is best viewed as longer-term optionality rather than a near-term catalyst. The company’s valuation today is driven primarily by its late-stage surgical infection program, D-PLEX100, which has reported positive Phase 3 results and is approaching a potential FDA submission. Roth Capital maintains a Buy rating on the stock, with published price targets in the high single digits to low teens based largely on the surgical site infection opportunity. At current levels, PolyPid trades around $4.6 per share, implying a market capitalization of $76 million.

At the same time, GLP-1 innovation continues to advance rapidly - from weekly injections to recently approved daily pills and now toward longer-acting delivery approaches. Oral GLP-1s represent a meaningful step forward, but they also underscore that dosing convenience and exposure consistency remain open competitive frontiers. As large pharmaceutical companies invest heavily in extending dosing intervals, smaller players working on delivery platforms are beginning to draw attention. PolyPid’s 60-day GLP-1 platform is early, but it aligns with where the industry is directing capital, positioning the company at the intersection of near-term execution and longer-term optionality.

Recent News Highlights from PolyPid:

PolyPid Announces Positive FDA Pre-NDA Meeting Minutes for D-PLEX₁₀₀ Supporting NDA Submission

PolyPid to Participate in ROTH Capital Partners Virtual KOL Event on December 10, 2025

PolyPid Provides Corporate Update and Reports Third Quarter 2025 Financial Results

Important Disclaimers and Disclosures: The author, Wall Street Wire, is a content and media technology platform that connects the market with under-the-radar companies. The platform operates a network of industry-focused media channels spanning finance, biopharma, cyber, AI, and additional sectors, delivering insights on both broader market developments and emerging or overlooked companies. The content above is a form of paid promotional content and advertising. Wall Street Wire has received cash compensation from PolyPid Ltd for promotional media services which are provided on an ongoing basis. This content is for informational purposes only and does not constitute financial or investment advice. Wall Street Wire is not a broker-dealer or investment adviser. Full compensation details, information about the operator of Wall Street Wire, and the complete set of disclaimers and disclosures applicable to this content are available at: wallstwire.ai/disclosures. Market size figures or other estimates referenced in this article are quoted from publicly available sources; we do not independently verify or endorse them, and additional figures or estimates may exist. This article should not be considered an official communication of the issuer.